Foreclosure is a stressful and overwhelming experience for homeowners, especially when they’re uncertain about their options. In [State], the threat of losing your home can feel imminent, but there are several ways to avoid foreclosure and regain control of your financial situation. Whether you’re behind on mortgage payments, struggling with unexpected expenses, or facing other financial hardships, there are strategies available to help you avoid foreclosure.

In this article, we’ll explore practical steps, exclusive information, and actionable tips to help homeowners in [State] prevent foreclosure. We’ll also discuss how to work with lenders, explore government programs, and offer guidance on selling your home quickly if necessary. Let’s dive into the best ways to avoid foreclosure in [State].

1. Understand Your Rights as a Homeowner in [State]

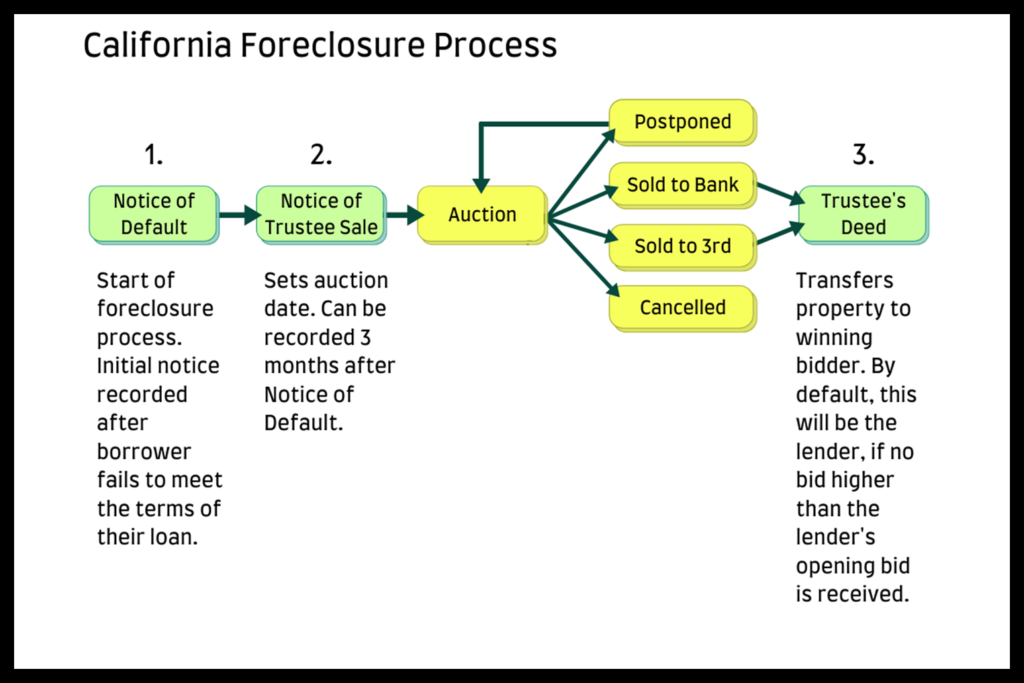

Before taking any action, it’s crucial to understand your rights as a homeowner in [State]. Foreclosure laws vary from state to state, and knowing your legal rights can help you make informed decisions. In some states, lenders must follow a specific process before they can foreclose on your home, including sending notices and offering opportunities for you to catch up on missed payments.

Actionable Tip: Research your state’s foreclosure laws or consult with a foreclosure attorney to ensure you understand your rights and the foreclosure process. In [State], there may be specific protections that can buy you time to explore other options.

2. Communicate with Your Lender Early

One of the best ways to avoid foreclosure is to maintain open communication with your lender. Many homeowners avoid contacting their lender due to fear of judgment or shame, but lenders are often willing to work with homeowners who are proactive in addressing their financial difficulties.

Actionable Tip: If you’re struggling to make mortgage payments, reach out to your lender as soon as possible. They may offer options such as forbearance, loan modification, or repayment plans to help you get back on track. The earlier you reach out, the more options you’ll have.

:max_bytes(150000):strip_icc()/GettyImages-15678514891-76b43476a39744ac81915c2307392a5d.jpg)

3. Consider Loan Modification or Refinancing

Loan modification is a popular solution for homeowners who are struggling to make their mortgage payments. This process involves negotiating with your lender to modify the terms of your loan, such as reducing your interest rate, extending the loan term, or adding missed payments to the loan balance.

Actionable Tip: If you qualify for a loan modification, it can lower your monthly payments and make your mortgage more affordable. Contact your lender or a HUD-approved housing counselor in [State] to explore this option.

Example: In [State], a homeowner named Sarah was able to reduce her mortgage payment by $400 per month through a loan modification after falling behind on her payments due to medical bills. This helped her avoid foreclosure and stay in her home.

4. Explore Government Assistance Programs

The federal government and state agencies offer various programs to assist homeowners who are at risk of foreclosure. Programs like the Home Affordable Modification Program (HAMP) and the Home Affordable Refinance Program (HARP) were designed to help homeowners in financial distress. Additionally, many states, including [State], have local programs that offer temporary relief.

Actionable Tip: Research available government programs in [State], such as the [State] Foreclosure Prevention Program or other state-specific relief initiatives. These programs may offer financial assistance, counseling services, or other resources to help you avoid foreclosure.

Example: The [State] Foreclosure Prevention Program helped John, a homeowner in [City], receive a temporary mortgage payment reduction while he worked with a financial counselor to improve his budget. As a result, he was able to catch up on his payments and avoid foreclosure.

5. Sell Your Home Quickly (If Necessary)

If you’re unable to catch up on your mortgage payments and foreclosure seems imminent, selling your home quickly may be the best option to avoid foreclosure. Selling your home through traditional methods can take time, but there are alternatives, such as selling to a cash home buyer, that can help you close the sale faster.

Actionable Tip: If you need to sell your home quickly to avoid foreclosure, consider working with a reputable cash home buyer in [State]. These buyers can often purchase your home “as-is,” without the need for repairs or lengthy negotiations, allowing you to close the sale in a matter of weeks.

Example: In [State], Mark was able to sell his home to a local cash buyer in just two weeks, preventing foreclosure and allowing him to pay off his mortgage balance. The process was straightforward, and he didn’t have to worry about making repairs or dealing with a real estate agent.

6. Seek Professional Help

If you’re feeling overwhelmed by the foreclosure process, consider seeking professional help. A foreclosure attorney or housing counselor can help you understand your options and negotiate with your lender. Many housing counselors offer free or low-cost services, and they can guide you through the process of avoiding foreclosure.

Actionable Tip: If you’re unsure of your next steps, schedule a consultation with a HUD-approved housing counselor or a foreclosure attorney in [State]. They can provide personalized advice and help you explore all available options.

7. Consider Bankruptcy as a Last Resort

As a last resort, filing for bankruptcy may help you avoid foreclosure. Bankruptcy can temporarily stop the foreclosure process and provide you with time to reorganize your finances. However, it’s important to understand the long-term consequences of bankruptcy before pursuing this option.

Actionable Tip: Consult with a bankruptcy attorney in [State] to understand the potential benefits and drawbacks of filing for bankruptcy. In some cases, bankruptcy can help you save your home, but it should be considered carefully.

Bankruptcy

Example: After facing a job loss and falling behind on mortgage payments, Tom filed for Chapter 13 bankruptcy in [State]. This allowed him to reorganize his debts and create a repayment plan, preventing foreclosure and allowing him to keep his home.

Conclusion

Foreclosure is a challenging experience, but it’s important to know that there are options available to homeowners in [State] to prevent it. By understanding your rights, communicating with your lender, exploring loan modifications, utilizing government programs, and seeking professional help, you can take proactive steps to avoid foreclosure. If necessary, selling your home quickly or filing for bankruptcy may also be viable solutions.

Remember, the earlier you take action, the more options you’ll have. Don’t wait until foreclosure is imminent—start exploring your options today to protect your home and your financial future.

Image suggestion: A hopeful image of a family in front of their home, with a “Saved” sign in the yard. This image can be placed at the conclusion to leave readers with a positive, encouraging note.